**IRAN CUTS INTERNET NATIONWIDE AMID DEADLY PROTEST CRACKDOWN**

Iran's government has taken a drastic measure to quell the growing protests across the country, shutting down the internet nationwide. The move comes as security forces crack down on demonstrators, resulting in dozens of deaths and widespread human rights abuses.

The unrest began 12 days ago, sparked by soaring inflation and the collapse of Iran's currency against the US dollar. Protests have since shifted from economic to political, with chants against Supreme Leader Khamenei gaining momentum. Despite the government's efforts to suppress the protests, demonstrators continued to take to the streets, with shops closing in Tehran's main bazaar and other cities.

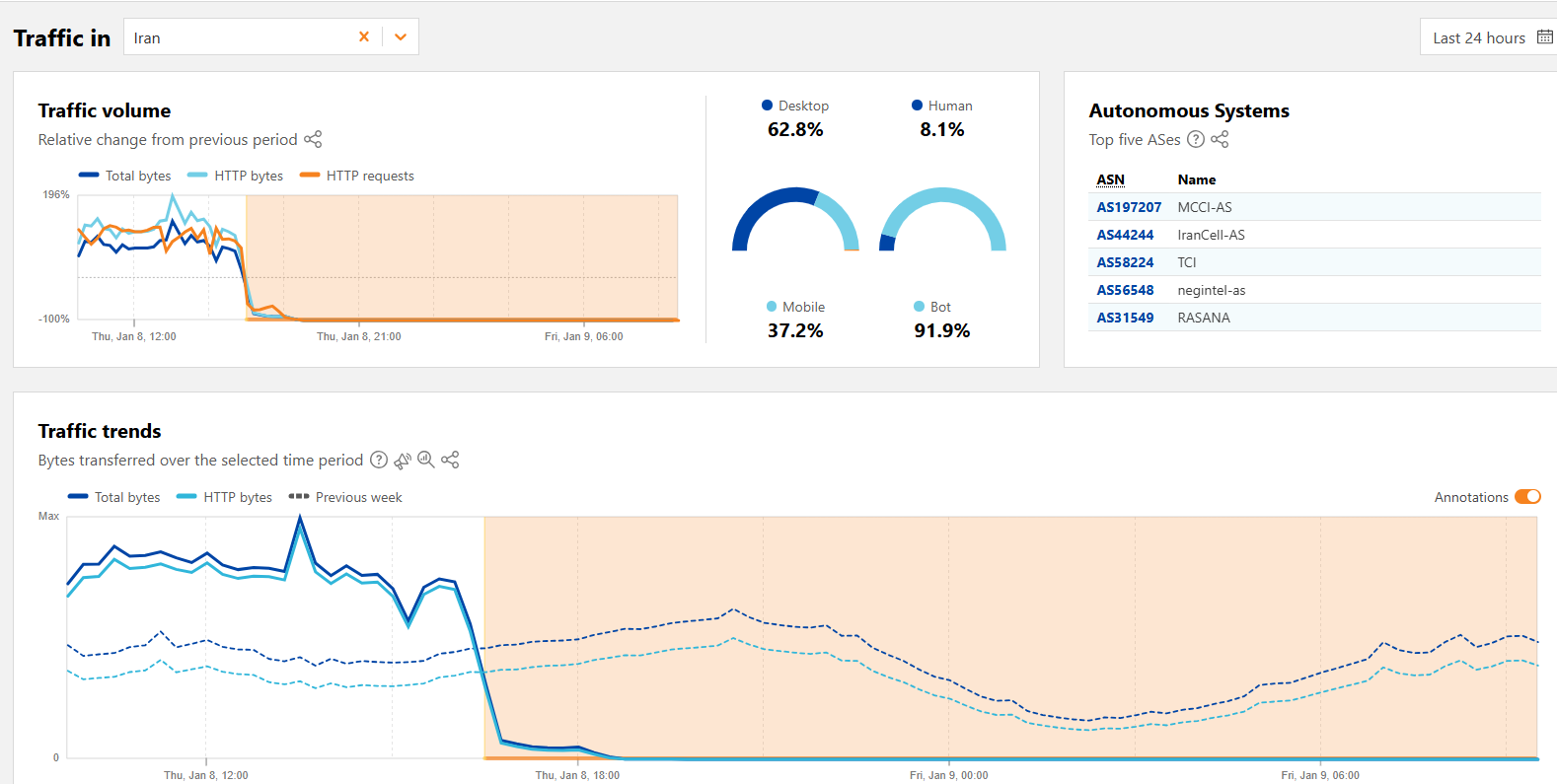

The internet blackout was imposed after a series of escalating digital censorship measures targeting protests across the country. According to NetBlocks, an independent global internet monitor, live metrics show that Iran has been offline for over 12 hours, with national connectivity flatlining at just 1% of ordinary levels.

Human rights groups have condemned the government's brutal crackdown on largely peaceful protests. Amnesty International reports that security forces have used live weapons, tear gas, beatings, and carried out mass arbitrary arrests, while pressuring families to cover up killings. The Hengaw group estimates 42 deaths, including six children.

The violence has drawn international attention, with President Donald Trump warning of possible intervention if killings continue. "People in Iran daring to express their anger at decades of repression and demand fundamental change are once again being met with a deadly pattern of security forces unlawfully firing at, chasing, arresting and beating protesters," said Diana Eltahawy, Amnesty International's Deputy Director for the Middle East and North Africa.

Tor Metrics data reveals a significant increase in users accessing the Tor network from Iran since the beginning of the protests. This trend is consistent with societies under acute political and informational stress, where individuals seek anonymity and censorship-resistance to navigate restricted information environments.

**Twitter Updates**

"Confirmed: Live metrics show #Iran is now in the midst of a nationwide internet blackout; the incident follows a series of escalating digital censorship measures targeting protests across the country and hinders the public's right to communicate at a critical moment" - NetBlocks

"Update: #Iran has now been offline for 12 hours with national connectivity flatlining at ~1% of ordinary levels, after authorities imposed a nationwide internet blackout in an attempt to suppress sweeping protests while covering up reports of regime brutality" - NetBlocks

**Rights Groups Condemn Government's Brutal Crackdown**

Amnesty International has documented widespread human rights abuses, including the use of live weapons, tear gas, beatings, and mass arbitrary arrests. "The Supreme National Security Council must immediately issue orders for security forces to stop the unlawful use of force and firearms," said Diana Eltahawy.

**Possible Intervention by US Government**

President Donald Trump has warned of possible intervention if killings continue. The international community is closely watching the situation, with human rights groups calling on governments to take action against Iran's government for its brutal crackdown on peaceful protests.

**Analysis**

The internet blackout imposed by the Iranian government is a stark reminder of the regime's willingness to suppress dissent and maintain control over information flows. As protests continue across the country, it remains to be seen how long the internet will remain shut down and what consequences this will have for the Iranian people's right to communicate and access information.