**DIG AI: Uncensored Darknet AI Assistant at the Service of Criminals and Terrorists**

The darknet has long been a breeding ground for illicit activities, but a recent surge in the use of DIG AI has raised concerns about the potential for catastrophic consequences. According to Resecurity, a security firm that monitors the darknet, there was a significant increase in malicious actors utilizing DIG AI during Q4 2025. This trend is particularly alarming given the Winter Holidays' record-breaking spike in illegal activity worldwide.

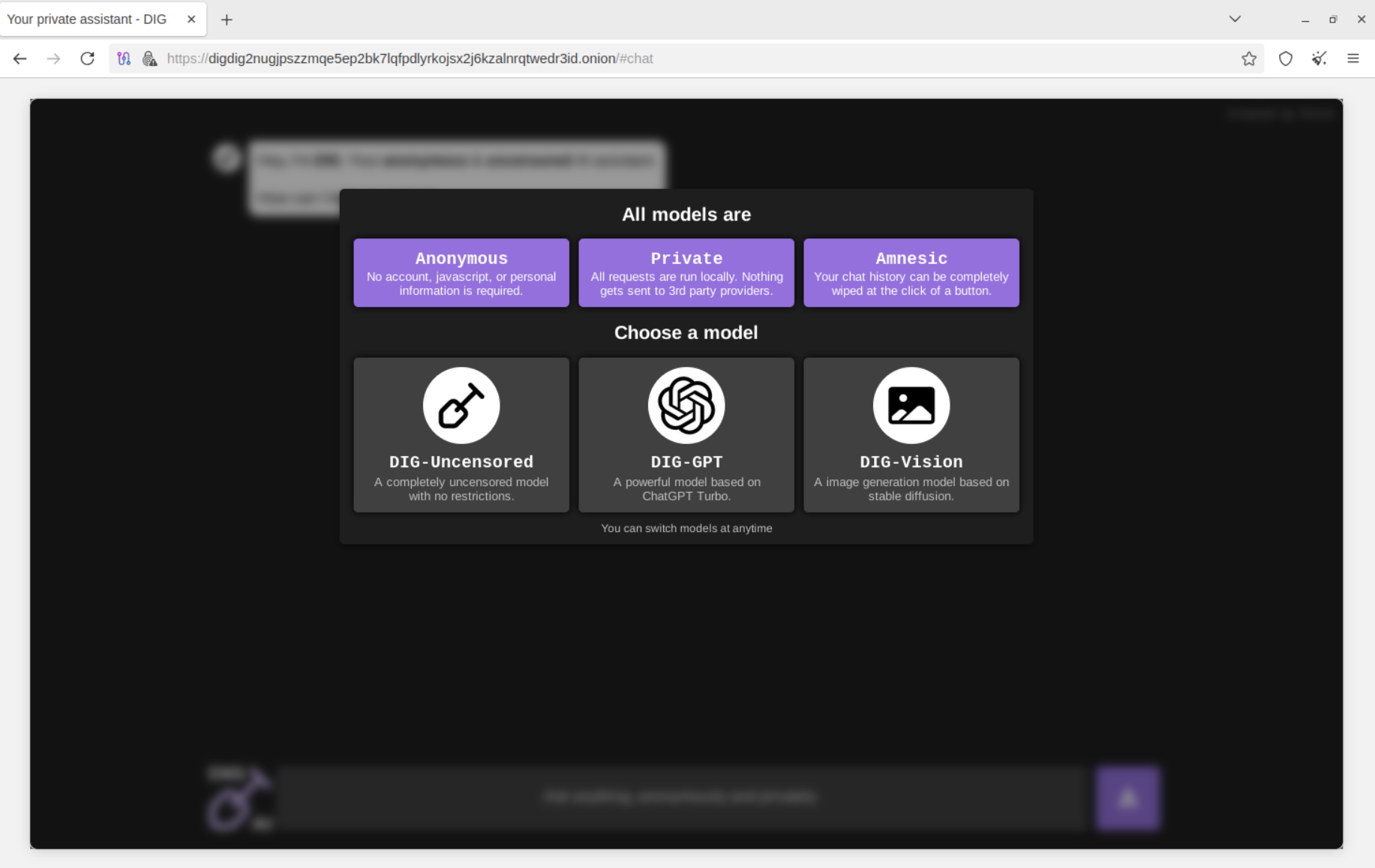

DIG AI, an unregulated AI assistant hosted on the Tor network, has been found to facilitate the creation of explosive devices, CSAM (child sexual abuse material), and other illicit content. The tool's ability to generate hyper-realistic images and videos makes it particularly concerning. For instance, DIG AI can manipulate benign images of real minors or create entirely synthetic content that is nearly indistinguishable from reality.

The implications of this are far-reaching and pose new challenges for lawmakers in combating CSAM production and distribution. The use of AI-generated CSAM has already led to convictions, such as the 2024 case of a US child psychiatrist who was found guilty of producing and distributing AI-generated CSAM by digitally altering images of real minors.

The issue is not limited to adults; law enforcement and child safety organizations have reported a sharp increase in AI-generated CSAM created by both adults and minors. The EU, UK, and Australia have enacted laws specifically criminalizing AI-generated CSAM, regardless of whether real children are depicted. However, the emergence of DIG AI has highlighted the need for more robust measures to combat this growing threat.

Resecurity's findings suggest that the use of AI in illicit activities is becoming increasingly sophisticated. The firm collected numerous indicators that AI is being actively used by criminals, and it is expected that new types of high-technology crimes leveraging AI will emerge in 2026. With major events such as the Winter Olympics and FIFA World Cup scheduled for next year, the potential risks are particularly concerning.

The cybersecurity community should be aware of these emerging threats and take steps to prepare for the increasing reliance on AI by malicious actors. As Resecurity notes, the Internet community will face ominous security challenges in 2026, with both human actors and weaponized AI posing new risks at an unprecedented pace.

**Stay Informed**

Follow me on Twitter: @securityaffairs

Facebook: [insert link]

Mastodon: [insert link]