#ProjectCompass Cracks Down on "The Com" Cybercrime Network, Nets 30 Arrests

In a significant operation, Europol's Project Compass has successfully cracked down on the notorious cybercrime network known as "The Com." The joint effort, coordinated by Europol's European Counter Terrorism Centre, has led to the arrest of 30 perpetrators and the protection of four children from harm. With its decentralized structure, The Com operates through various online platforms, including social media, messaging apps, gaming platforms, and streaming services, making it a challenging target for law enforcement.

The Com network is composed mainly of English-speaking cybercriminals aged 16 to 25, who have been linked to various malicious activities such as crippling British retailers' IT systems, making bomb threats, and coercing teenage girls into self-harm. Its latest alleged victims are premium users of Pornhub, whose data was reportedly hacked by ShinyHunters, an offshoot tied to the broader Com network, which includes Scattered Spider.

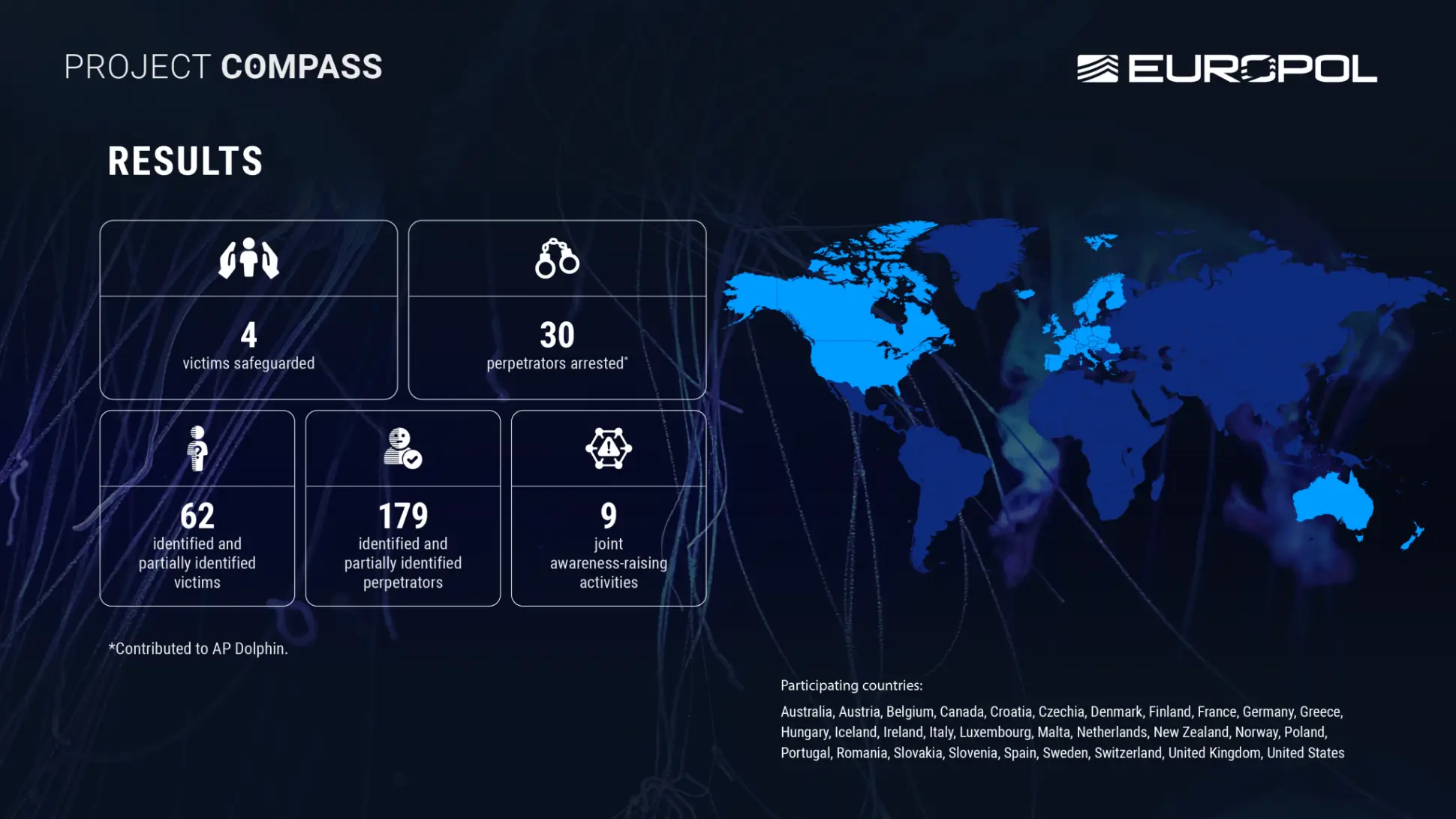

Project Compass, a yearlong operation, has delivered significant operational results, including the safeguarding of four victims and the arrest of 30 perpetrators. Investigators identified or partially identified 62 victims and 179 suspects, while also carrying out nine joint awareness initiatives. This project has strengthened cross-border cooperation among 28 countries, enabling coordinated investigations, faster responses to emerging threats, and structured information sharing.

"The Com" networks deliberately target children in the digital spaces where they feel most at ease. Project Compass allows us to intervene earlier, safeguard victims and disrupt those who exploit vulnerability for extremist purposes," said Anna Sjöberg, Head of Europol's European Counter Terrorism Centre. "No country can address this threat alone – and through this cooperation, we are closing the gaps they try to hide in."

The success of Project Compass is a testament to the power of international cooperation in combating cybercrime. By bringing together law enforcement agencies from 28 countries, Europol has created a formidable force against online threats. As cybersecurity threats continue to evolve, it's essential for organizations and individuals to stay vigilant and adapt to new tactics.

In conclusion, the arrest of 30 perpetrators by Project Compass is a significant blow to The Com network, and a major victory in the fight against cybercrime. As law enforcement agencies continue to work together to combat online threats, it's essential to remain informed about the latest developments and best practices for staying safe in the digital age.

Keywords: #cybersecurity #ProjectCompass #TheCom #Europol #Cybercrime #Malware #Vulnerability #DataBreach