**FBI Takes Notorious RAMP Ransomware Forum Offline**

The FBI has made a significant blow to the world of cybercrime by seizing control of RAMP (Russian Anonymous MarketPlace), a notorious online forum that had become a hub for ransomware operators and other cybercriminals. The forum, which was known for its brazen attitude towards law enforcement, boasted over 14,000 users and was considered one of the most popular platforms for ransomware-related activities.

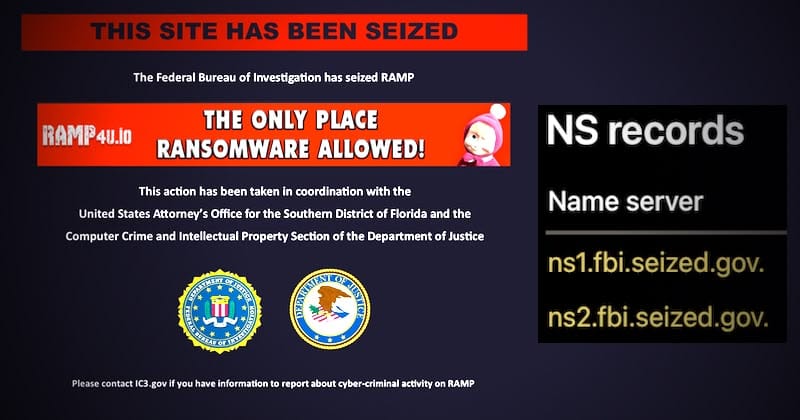

RAMP's presence on both the dark web and its regular website domain now display a notice from the FBI announcing that it has been taken over by law enforcement. The seizure banner is accompanied by a cheeky addition - a winking Masha from the popular Russian children's TV cartoon series "Masha and the Bear" - a nod to the forum's Russian roots.

According to the message posted on the seized websites, RAMP was taken down in collaboration with the US Attorney’s Office for the Southern District of Florida and the US Justice Department’s Computer Crime and Intellectual Property Section (CCIPS). The FBI's involvement is a significant development, as it suggests that they have been monitoring the forum's activities closely.

RAMP first emerged in mid-2021, filling a void left by other major Russian-language hacking forums that had banned ransomware-related content following pressure from law enforcement. However, its popularity soon made it a target for authorities. The site served as a marketplace where ransomware operators could recruit affiliates, initial access brokers could sell credentials for compromised business networks, and cybercriminals could trade their stolen data and tools.

Many infamous ransomware groups, including ALPHV/BlackCat, Qilin, DragonForce, and RansomHub, used the RAMP platform to promote their operations. The site's administrators even boasted about its popularity, claiming that it was "the only place ransomware allowed." However, things started to go wrong for RAMP when one of its administrators, Mikhail Matveev (also known as "Orange", "Wazawaka", and "BorisElcin"), was listed on the FBI's most wanted list in 2024.

Matveev's arrest marked a turning point for RAMP, and it's likely that the forum's administrators knew their time was running out. Following the seizure of RAMP, another alleged operator, known as "Stallman", confirmed the takedown in a posting on another hacking forum. In a cryptic message, "Stallman" wrote: "This event destroyed years of my work to create the most free forum in the world, and although I hoped this day would never come, deep down I always understood that it was possible."

While the seizure of RAMP is a significant blow to cybercrime, it's unlikely to eliminate ransomware overnight. However, it does represent a meaningful disruption of cybercriminal infrastructure, as hackers will be forced to migrate their activities and navigate new challenges related to operational security and trust.

The seizure also suggests that the authorities now have access to RAMP's user data - including email and IP addresses, private messages, and more. This could lead to arrests in the coming months, as law enforcement agencies use this information to track down cybercriminals.

**The Fallout**

As Flare reports, "Stallman" has indicated that the cybercriminal activity conducted through RAMP would continue through other channels. While this may be a setback for authorities, it's unlikely to deter determined cybercriminals. However, the seizure of RAMP does represent a significant shift in the balance of power between law enforcement and cybercrime.

The FBI's involvement in the takedown also suggests that they have been monitoring RAMP's activities closely. The fact that they were able to seize control of the forum with such speed and efficiency is a testament to their ability to adapt to the ever-evolving world of cybercrime.

**Conclusion**

The seizure of RAMP is a significant development in the ongoing battle against cybercrime. While it may not eliminate ransomware overnight, it does represent a meaningful disruption of cybercriminal infrastructure. As hackers are forced to migrate their activities and navigate new challenges related to operational security and trust, law enforcement agencies will be watching closely for any signs of resurgence.

The RAMP takedown is also a reminder that the authorities have access to user data - which could lead to arrests in the coming months. It's a timely reminder of the importance of vigilance in the face of cybercrime, and the need for law enforcement agencies to stay one step ahead of these determined hackers.